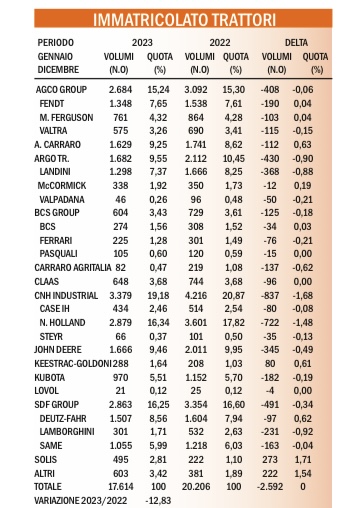

As the croupiers say when they release the ball on the roulette wheel, “le jeux sont fait.” The games are over, and from that moment on, no one can move or add chips to the table. An expression that also applies to the registered tractors at the end of the year, meaning that the volumes published on this page are final and paint a rather uninspiring picture for the sector.

Indeed, the market closes the year with a slowdown in registrations approaching 13 percent, with no prospects of recovery in sight and sales data causing much concern, indicating a decline in volumes of over thirty percent. This situation certainly does not come as a surprise to operators, but it could have been avoided by favoring less significant but more long-term support measures, commonly referred to as “structural.”

Complicating matters further is the continuous postponement of regulations aimed at regulating revisions.

The situation of the tractor market in Italy

The fact that no government has yet been willing to make decisions regarding this matter confirms how the measure has been frowned upon by all political coalitions that have succeeded each other at Palazzo Chigi. They are aware that it would force most companies to incur significant expenses and would therefore be unpopular in terms of consensus. Ultimately, Italy’s tractor sector also suffers from the incompetence of the current political class, a problem that adds to the increasingly overwhelming spread of low-power Asian tractors.

These are technically more than decent machines, boasting price tags that are impossible for domestic products to match. Brands most involved in the compact and specialized tractor sectors are bearing the brunt of this situation, compounded by a trend of agricultural industrialization that is increasing national average powers.

Conversely, brands operating in the medium, high, and very high-performance sectors are smiling. These are areas where foreign products reign supreme, especially when boasting a higher horsepower under the hood. It’s no coincidence that out of six mainstream brands capable of boasting four-digit registration volumes, three are foreign and are gaining market share compared to the three Italian brands.

As often noted, it wouldn’t be a bad idea if Italian farmers and breeders chose their machinery with the same spirit with which they defend their productions.